Occasionally, customers fall behind on their payments or decide to stop paying a loan.

You may elect to close the loan for default reasons and/or repossess the vehicle sold.

When this occurs, you must mark the customer's loan as being in default status.

Closing a Loan for Default/Repossession

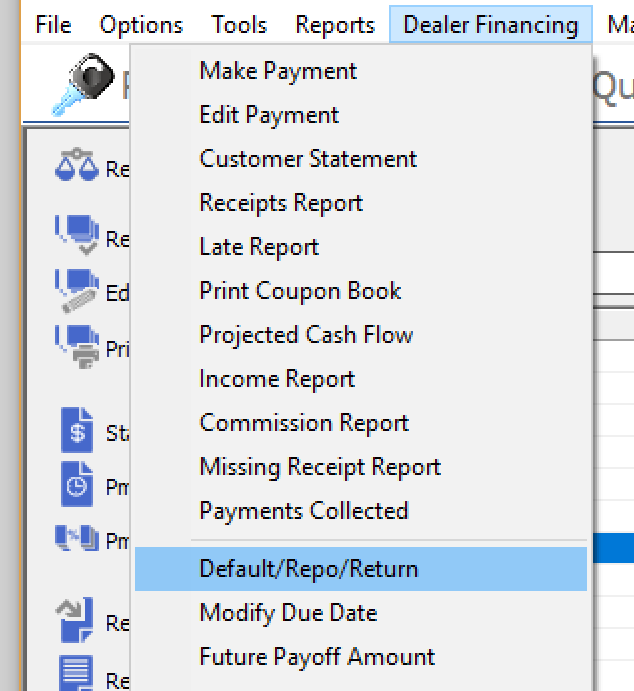

Click to select and highlight a customer's name within the Buy Here/Pay Here customer list. Once the customer has been selected, click on the Dealer Financing menu at the top of the screen. Select the Default/Repo/Return option in the pull-down menu.

When you select this option, the Repossess Vehicle window will appear.

Enter the following information:

•Name of the authorizing salesperson. You may use the drop-down box to select a name from a list. This list comes from the names of the salespersons entered VIA Salesperson Maintenance.

•Enter the book value of the vehicle at the time of repossession. This value will be used in profit calculations within the system.

•Enter the date of the loan default/repossession. This date is important since the system calculates interest on a daily basis -- the date you enter here will determine the last date of interest to accrue on the loan.

•Enter the action taken on this loan (for record-keeping purposes).

•If you wish to have the vehicle placed into your inventory for resale, check the Restock Vehicle box. A new inventory record for this vehicle with a different stock number is created. This is necessary in order to keep a record of past sales since stock numbers are unique vehicle identifiers within the system. When the vehicle is restocked, the system cannot overwrite the previous vehicle record since it is being used in the deal for which the repossession was done.

When you apply the default/repossession action to a loan, the system creates a repossession-type payment which brings the loan's balance to zero. This closes the loan within the system and removes it from the list of active loans. Note: this payment is not treated as a regular payment within the system since you did not receive actual money from the customer. It is handled as a special case when calculating profits/losses and income reports -- this is where the book value of the vehicle comes into play.

A receipt for the repossession-type payment is generated for your records.

If the customer wishes to reclaim the vehicle, you may remove the repossession-type payment to bring the loan back into active status by following the steps of deleting a payment.